401K MEP Retirement Plans & Cost Savings for Businesses

Discover how we can help you reduce administrative burdens, strengthen compliance, and maximize savings for your business.

Home › 401K MEP Retirement Plans & Cost Savings for Businesses

Running a small retail business means juggling countless responsibilities, from managing inventory to ensuring exceptional customer service—it's a lot to handle. That's why the Alliance of State Retail Associations 401k Plan & Trust, a closed Multiple Employer Plan (MEP) designed by retailers for retailers, is here to help. We understand the unique challenges retailers face, and our MEP retirement plan for small business is tailored to reduce administrative burden 401k providers typically create. With our comprehensive solution, you can confidently provide small business retirement plans to your employees through 401k plan outsourcing that delivers real 401k plan cost savings, freeing up your time to focus on what truly matters: growing your business.

Administrative relief and reduced fiduciary responsibility are two primary benefits for adopting employers in our MEP retirement plan for small business. Here's how our structure streamlines your retirement plan management:

The plan's service providers handle all aspects of compliance testing, including preparing census data and providing documentation to the recordkeeper—a key advantage of 401k plan outsourcing.

By aggregating assets under a single plan, MEP adopters may achieve economies of scale typically enjoyed by much larger plans. This delivers 401k plan cost savings that lower investment and administrative fees and improve service levels for participants.

You no longer need to complete a Form 5500. A service provider on the plan files one form covering all adopting employers, helping to reduce administrative burden 401k plans typically require.

Your organization can offload the required audit, which will be handled at the plan sponsor level.

Eligible employers may receive a tax credit of up to $5,000 per year for the first three years of the plan, effectively covering a substantial portion of the administrative expenses associated with setting up and maintaining small business retirement plans.

For eligible employers that make contributions to employee retirement accounts, such as a 401(k) or SIMPLE IRA, the SECURE 2.0 Act offers a credit equal to 100% of qualifying contributions made for employees who are eligible for the plan. This credit can be up to $1,000 per employee per year for the first five years the plan is in place, delivering significant 401k plan cost savings.

The SECURE 2.0 Act includes provisions aimed at enhancing retirement savings through the establishment of automatic enrollment in employer-sponsored retirement plans. One significant feature of this legislation is the introduction of a tax credit for small businesses that implement automatic enrollment in their MEP retirement plan for small business.

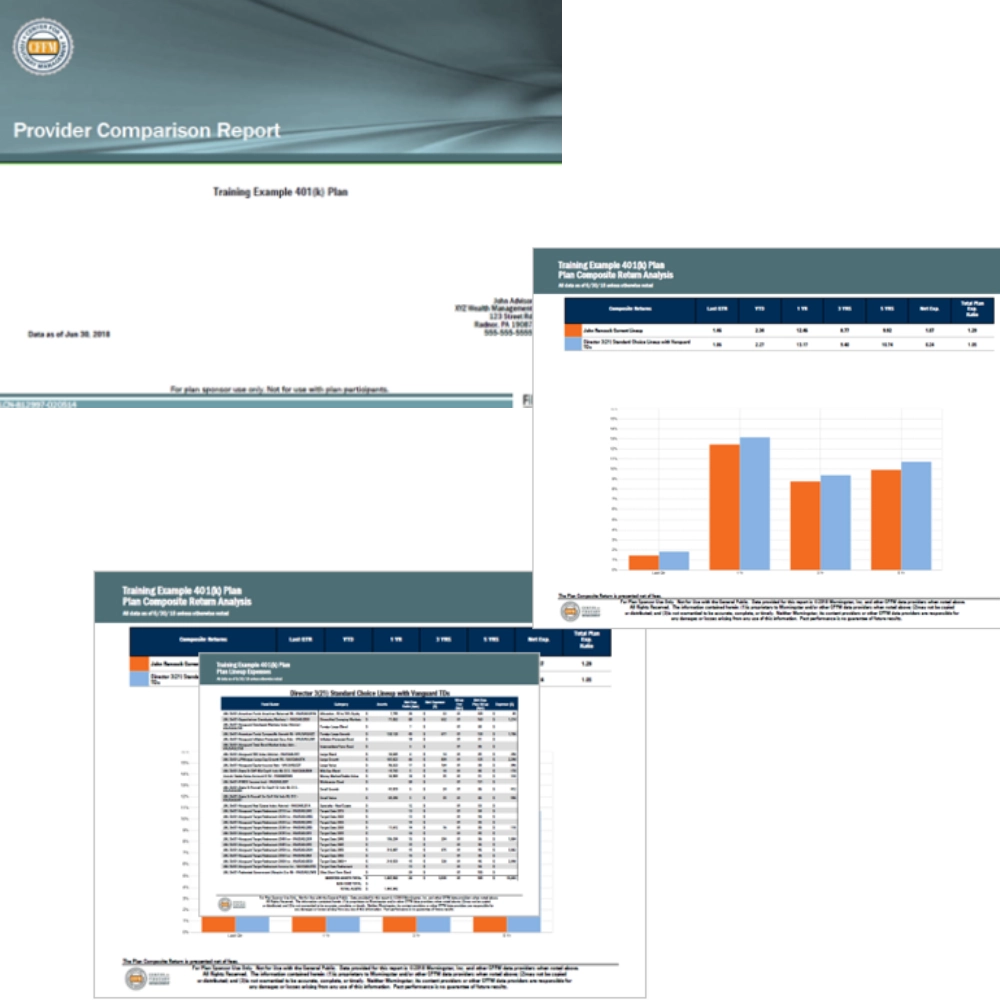

To facilitate informed decision-making, a complementary benchmark analysis can be provided for interested employers. This analysis will compare their current small business retirement plans features and costs against industry standards, highlighting areas for improvement and potential 401k plan cost savings. By understanding how their offerings stack up against competitors, employers can make strategic adjustments to enhance their benefits package and identify opportunities to reduce administrative burden 401k plans typically create.

| Mep Advantage | Asra Included |

|---|---|

| Flexible Plan Design | |

| Eliminate Annual Audit | |

| Eliminate Form 5500 | |

| Eliminate Fidelity Bond | |

| Ellminate Fiduciary Liability Policy | |

| 3(38) Discretionary Investment Oversight | |

| Institutional Investment Menu | |

| 3(16) Plan Administration | |

| Payroll Integration Available | |

| BYOA (Bring Your Own Advisor) |

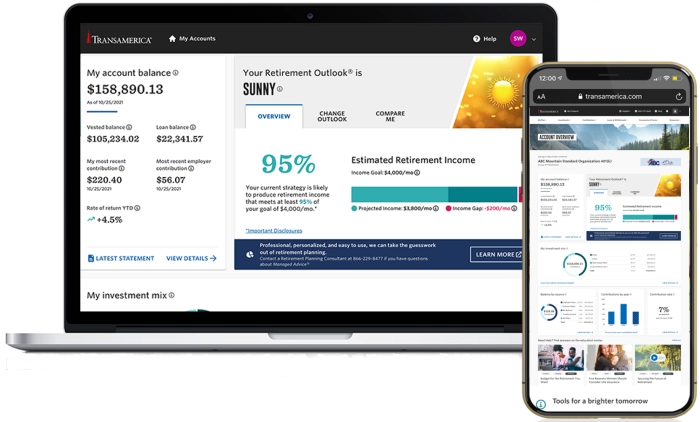

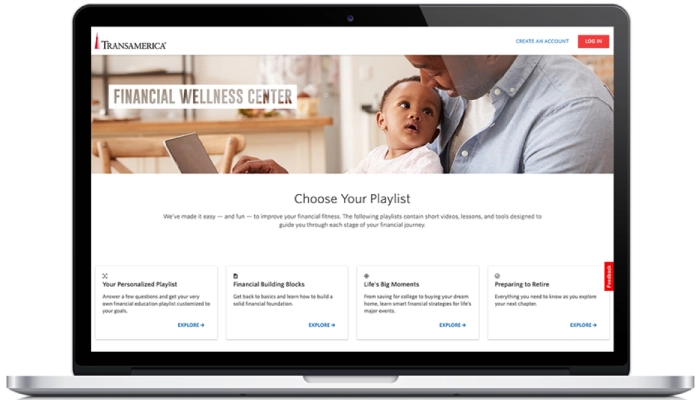

Our MEP retirement plan for small business provides participants with a modern, user-friendly plan portal that makes managing retirement savings simple and accessible, with real-time access to account balances, investment options, and personalized retirement planning tools. For employers, the portal streamlines plan administration and reduces administrative burden 401k management typically requires, with automated reporting, compliance tracking, and easy access to plan documents. This comprehensive digital experience ensures both employers and employees have the information and tools they need at their fingertips, making 401k plan outsourcing seamless and efficient.

Retail401K provides affordable, easy-to-manage 401k retirement plans designed specifically for small businesses and retail owners in Augusta and throughout the United States. As a Multiple Employer Plan (MEP) provider, we help small companies offer competitive retirement benefits without the typical administrative headaches and high costs. Our approach reduces fiduciary liability while giving your employees access to quality investment options and professional plan management. Whether you're starting your first 401k or looking to switch from a complicated existing plan, we make the process simple and cost-effective. Small businesses deserve the same retirement plan advantages as large corporations, and that's exactly what we deliver. We handle the complex compliance work so you can focus on running your business. Call 844-637-4015 to learn how Retail401K can help you attract and retain great employees with a retirement plan that actually works for small businesses.

Retail401K

45 Melville Street, Unit 1

Augusta, ME 04330

Monday-Friday: 9.00 AM – 5.00 PM

3(38) Investment Fiduciary Services offered through Atlas Fiduciary Services, Inc., a Registered Investment Advisor https://www.investor.gov/CRS 3(16) Plan Administration and Third-Party Administrative Services offered through Atlas Pension Administrators, Inc. Retail Association of Maine, Plan Sponsor, Alliance of State Retail Associations 401k Plan and Trust, DBA: Retail401k. Recordkeeping services offered through Transamerica Retirement Services. Individual Financial Advisors may be contracted by adopting employers to offer this Multiple Employer Retirement Plan and are separate engagements from all other servicing partners.

By using our website, you agree to the use of cookies as described in our Cookie Policy