Health Savings Accounts That Work With Your 401k Plan

Reduce your fiduciary risk and simplify plan management with professional oversight from experts dedicated to your organization’s compliance, efficiency, and success.

Home › Health Savings Accounts That Work With Your 401k Plan

Your team works hard. They show up early, stay late, and keep your business running. But when it comes to healthcare costs, many of them struggle. What if you could offer a benefit that helps them save money on medical expenses while building long-term wealth?

Retail401K now offers Health Savings Accounts (HSAs) that work alongside your retirement plan. It's one more way to take care of your people without breaking your budget.

Healthcare is expensive. Your employees feel it every time they visit the doctor or pick up a prescription. An HSA gives them a smart way to pay for medical costs with pre-tax dollars.

Our smart card technology makes it easy for employees to access their healthcare dollars. Here's what we offer:

This is the big one. Employees can use it for immediate medical expenses or invest it for retirement. The money grows tax-free and never expires. It's like a retirement account specifically for healthcare.

Employees fund this account through payroll deductions. They need to use the money within the year, which makes it perfect for predictable expenses like glasses or dental work. We also offer a dependent care option for childcare costs.

You fund this account as the employer. It's a great way to help employees with out-of-pocket costs. You decide if unused money rolls over to the next year. Some businesses use HRAs as rewards for wellness programs.

This helps employees pay for commuting costs like parking or public transit. The money comes from their paycheck pre-tax, which saves them money on every commute.

The smart card knows which account to pull from first, so your employees don't have to think about it.

Most benefits websites are confusing. Ours isn't. We built it to answer questions and make tasks simple.

Your employees can handle most tasks themselves:

No waiting on hold. No complicated forms. Just quick, easy access to their money.

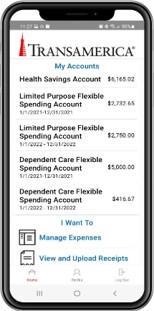

Most people check their phone dozens of times a day. Our app makes managing healthcare accounts just as easy as checking social media.

Always Available:

Clear Information:

Quick Actions:

Already have a 401k plan with Retail401K? Adding HSAs is simple. Everything integrates into one system.

Don't have a retirement plan yet? No problem. We can offer the HSA as a standalone benefit. But when you're ready to add a 401k, the integration is already built in.

Good employees have choices, and healthcare benefits matter when they're picking where to work. Without them, you risk losing talented people to competitors who offer more. The cost of constantly hiring and training replacements adds up quickly. For a small monthly investment, an HSA shows your team you care about their wellbeing and gives them a real tool to handle medical costs and build financial security. You built your retail business by taking care of customers—now it's time to take care of the people who make it all happen. Retail401K makes it affordable and simple. We handle the paperwork, provide the education, and answer the questions while you get the credit for offering a benefit that actually helps.

Your retail business succeeds because of your people. Show them they matter with benefits that make a real difference in their lives. Call Retail401K at 844-637-4015 to learn more about adding Health Savings Accounts to your benefits package.

Retail401K provides affordable, easy-to-manage 401k retirement plans designed specifically for small businesses and retail owners in Augusta and throughout the United States. As a Multiple Employer Plan (MEP) provider, we help small companies offer competitive retirement benefits without the typical administrative headaches and high costs. Our approach reduces fiduciary liability while giving your employees access to quality investment options and professional plan management. Whether you're starting your first 401k or looking to switch from a complicated existing plan, we make the process simple and cost-effective. Small businesses deserve the same retirement plan advantages as large corporations, and that's exactly what we deliver. We handle the complex compliance work so you can focus on running your business. Call 844-637-4015 to learn how Retail401K can help you attract and retain great employees with a retirement plan that actually works for small businesses.

Retail401K

45 Melville Street, Unit 1

Augusta, ME 04330

Monday-Friday: 9.00 AM – 5.00 PM

3(38) Investment Fiduciary Services offered through Atlas Fiduciary Services, Inc., a Registered Investment Advisor https://www.investor.gov/CRS 3(16) Plan Administration and Third-Party Administrative Services offered through Atlas Pension Administrators, Inc. Retail Association of Maine, Plan Sponsor, Alliance of State Retail Associations 401k Plan and Trust, DBA: Retail401k. Recordkeeping services offered through Transamerica Retirement Services. Individual Financial Advisors may be contracted by adopting employers to offer this Multiple Employer Retirement Plan and are separate engagements from all other servicing partners.

By using our website, you agree to the use of cookies as described in our Cookie Policy